Contract Labor vs. Employee :

What's the Difference?

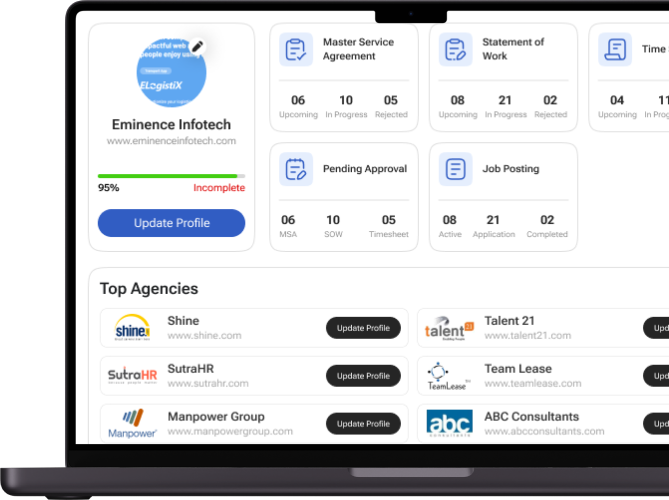

AI-powered copilot that mitigate risk, increase compliance and Operations for Global teams

Contract Labor vs. Employee: What's the Difference?

Uncertain about the distinctions between contract labor and employees? This article thoroughly outlines the legal implications associated with each of these categories.

Are you struggling to differentiate between an independent contractor and an employee? Finding it challenging to grasp the legal ramifications of these two employment classifications?

The distinction between these categories can often be hazy, whether you're a small business proprietor or a senior executive in a large corporation. Deciphering the appropriate employee type for your company can be perplexing.

This article aims to provide clarity by exploring the benefits, legal consequences, and tax implications associated with hiring independent contractors and employees.

Contract labor encompasses work conducted through individual written agreements, signifying that your company does not formally employ contract laborers. They do not receive a regular salary or employee benefits.

Payment for contract labor is made upon completion of specific tasks or projects, and once the job is finished, the contractual relationship typically concludes, unless further services are requested.

Many contractors operate their own businesses, which is why the common law categorizes independent contractors as self-employed individuals, implying that they work for themselves. Consequently, federal employment laws do not extend coverage to independent contractors.

Given that the Internal Revenue Service (IRS) classifies independent contractors as self-employed, they are responsible for paying their own taxes, including self-employment tax.

Should you engage an independent contractor, it is your obligation to report their earnings as a deduction from your income. You will also need to furnish them with a 1099-MISC form and submit an IRS Form 1096 to document the total payments made to them.

- Invoice Autonomy: The worker is responsible for generating their own invoice.

- Flexible Work Hours: The worker has autonomy over the hours they work.

- Personal Tools: Typically, the worker utilizes their own equipment and tools.

- Termination Flexibility: Your company has the prerogative to terminate the worker from the position at any time, as long as it adheres to the terms of the contract.

Absence of Benefits: Your company does not provide the worker with benefits such as health insurance, Medicare, Social Security, worker's compensation, state unemployment tax (i.e., Department of Labor), or coverage under the Family Medical Leave Act, among others.

Hiring an independent contractor offers several advantages, including:

Cost Efficiency: Independent contractors are typically a cost-effective solution since they do not require an annual salary or certain expenses like unemployment insurance. Additionally, you can avoid significant expenditures on their training and integration into your business operations.

Immediate Impact: Independent contractors have a short-term commitment with your small business, which allows them to make a more immediate and focused impact.

Flexibility: Engaging an independent contractor usually does not entail a long-term commitment or permanency. This grants you the flexibility to establish the duration of the employment relationship, whether it be short-term or long-term.

An employee is an individual directly employed by your company, placed on your payroll, and typically engaged in full-time work, receiving mandatory employee benefits.

Typically, you will extend an offer letter or an employment contract to delineate the terms of their employment. While employees may have room for negotiating their salary, this is not always the case.

Withholding federal and state taxes, FICA, Social Security taxes, and Medicare taxes is a customary practice when employing workers. Employees often enjoy entitlements such as benefits, sick leave, vacation time, and other job-related perks.

Hiring an employee typically signifies a commitment to establishing a long-term business relationship. Employment contracts often outline the specific hours they are expected to work, whether on a full-time or part-time basis. Depending on your company's policies, compensation may be structured on an hourly or salaried basis.

In most instances, employers furnish employees with the necessary tools and equipment required to perform their duties. This commonly includes items like phones, computers, laptops, desks, and supplies.

There are numerous compelling reasons to bring an employee on board. For instance, if your company places great importance on fostering a strong team dynamic, then hiring an employee is an ideal choice. Full-time employees can contribute significantly to building cohesive and well-coordinated teams.

Employing an individual as an employee also becomes a sound decision when you seek talent that can develop a deep familiarity with your business. An employee who becomes intimately acquainted with your company is more likely to work efficiently and achieve higher levels of job performance.

So, what distinguishes an employee from an independent contractor? What are the key distinctions between these two types of workers? And which one aligns best with the needs of your business?

Federal and state labor laws, such as the Fair Labor Standards Act, govern the rights and obligations of employees but do not typically extend to independent contractors.

A potential employee applies for a position within your company. If their qualifications and experience align with your hiring manager's or department's expectations, you may extend a job offer to them.

Once an employee accepts the job offer, your company often collects identifying information, such as their date of birth, marital status, and citizenship status.

In contrast, an independent contractor typically engages in discussions with a specific department within your company. The contractor might submit a proposal detailing the services they can offer. Following this, they typically enter into a contract with your legal team to formalize the arrangement.

Regarding taxation, employees generally complete a W4 form, wherein they furnish their name, address, social security number, tax filing status, and the number of exemptions they claim.

Conversely, independent contractors, as taxpayers, typically submit a W9 form. This form includes their name, address, tax identification number, and a certification regarding potential backup income tax withholding as required by the IRS.

Employees are eligible for state and federal unemployment benefits, a privilege not extended to independent contractors. However, it is crucial to accurately classify the worker's employment status, as misclassification can result in severe financial and legal penalties.

Your payroll department disburses payments to employees according to predetermined pay periods, typically outlined in the employment contract. In the case of full-time employees, the contract generally specifies a fixed gross pay. Monetary employee benefits are typically detailed within the worker's compensation package as outlined in the contract.

Conversely, accounts payable handles payments to independent contractors upon receipt of their invoice. The terms of payment, including timing and frequency, are usually stipulated in the contract and often structured around project milestones or deliverables.

The classification of an individual as an independent contractor is contingent upon the specific contract they enter into with a company. Contract labor pertains to work for which an employer compensates on a project-by-project basis, rather than an hourly wage.

Even if you initially computed payment using an hourly rate, you are typically obligated to remunerate them according to the predetermined amount stipulated in the contract.

To facilitate payment to an independent contractor, the initial step involves them filling out a W9 form. This form gathers their personal information, which you will use for reporting their annual earnings.

Once the contract worker fulfills the task outlined in the contract, you can disburse their payment, typically via check or direct deposit. When compensating an independent contractor, follow these steps:

Incorrectly categorizing an employee as an independent contractor may result in substantial fines and tax liabilities, potentially amounting to thousands of dollars.

Some organizations mistakenly misclassify workers in an attempt to evade providing standard employee benefits, including paid time off (PTO), medical insurance, and the employer's share of payroll taxes.

If you have reservations about whether your contractor might be misclassified as an employee, you can refer to the "economic reality" test offered by the FLSA (Fair Labor Standards Act) to assess your adherence to all relevant regulations.

Perhaps you have collaborated with a contractor on numerous occasions and are now considering bringing them onboard as a full-fledged employee. The transition from contractor to employee typically follows a structured process, which generally unfolds as follows:

Before embarking on the process of transitioning a contractor into a full-fledged employee, it is crucial to ascertain their proper classification. This can be achieved by submitting a Form SS-8 to the IRS and applying the three-prong test, which encompasses:

- The extent of control exercised over the worker's actions.

- The level of financial control maintained over the worker.

- The nature and duration of the working relationship.

Once you conclude that the conversion to an employee is appropriate, you will shift from using Form 1099 to Form W-2 for tax reporting purposes.

Ensure that the worker is aware of the transition from an independent contractor to an employee. It is advisable to communicate this change in writing, as it provides a more reliable record compared to verbal communication.

Take into consideration that independent contractors highly value their autonomy. Therefore, it is essential to present them with an enticing and competitive benefits package that is difficult to decline.

Ensure your new employee feels embraced by your company by acquainting them with the team and guiding them through the onboarding procedure. Additionally, you might want to contemplate appointing a mentor to aid their assimilation into the new role and acquaint them with the dynamics of being a full-time employee.

Collaborate with your HR department to compile all essential details and create a new employee record. The transition from paying the new employee through a W9 to becoming a regular employee necessitates an adjustment in your payroll procedures. Be sure to update your payroll system accordingly when adding them to it.

Comprehending the intricacies of engaging independent contractors, especially in international hiring scenarios, can be more intricate than anticipated.

This is precisely where Agreementpaper can provide valuable assistance. Our comprehensive solution is designed to ensure your compliance when hiring globally, preventing potential pitfalls associated with overseas hiring.

We are dedicated to ensuring that you possess the appropriate documentation, minimizing legal complexities and operational burdens. To learn more about how we can effectively guide you through compliance challenges, we invite you to request a demonstration today.